Beneficial

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

Easy and fast solutions at your fingertips. Apply from anywhere, with just one document required

A responsible lending approach with a focus on security. We safeguard your information and provide help in tough spots

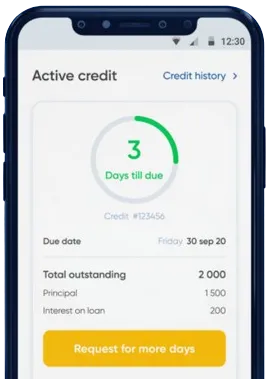

Easy and quick solutions without leaving home. Money is instantly transferred, with loan extension options

Use the app to send your request, simply fill in the form.

Wait for our quick decision, which takes only 15 minutes.

Get your loan deposited, typically in just one minute.

Use the app to send your request, simply fill in the form.

Download loan app

Small instant loans have become a popular financial tool for many individuals in South Africa. These loans offer quick and easy access to funds, making them a convenient option for those in need of immediate financial assistance. There are several benefits and advantages to opting for small instant loans in South Africa.

One of the primary benefits of small instant loans is the convenience and accessibility they offer. These loans can be applied for online or through mobile apps, making the application process quick and easy. Additionally, funds are usually disbursed within a short period, sometimes within hours, providing immediate assistance to those in need.

Another advantage of small instant loans is that they often do not require any collateral. This makes them accessible to individuals who may not have assets to secure traditional loans. As a result, small instant loans are a viable option for those who need funds urgently but do not have valuable assets to put up as collateral.

Small instant loans typically offer flexible repayment options, allowing borrowers to choose a repayment plan that suits their financial situation. Some lenders may offer the option to repay the loan in installments, making it easier for borrowers to manage their finances. This flexibility ensures that borrowers can repay the loan without putting additional strain on their finances.

Small instant loans are particularly useful for individuals who find themselves in emergency situations and need immediate financial assistance. Whether it's unexpected medical expenses, car repairs, or other urgent needs, small instant loans can provide the necessary funds to cover these unforeseen expenses. The quick approval process and fast disbursal of funds make small instant loans a reliable option for emergency situations.

Small instant loans in South Africa offer a range of benefits and advantages to individuals in need of quick financial assistance. From convenience and accessibility to flexible repayment options and emergency assistance, these loans provide a practical solution for those facing unexpected financial challenges. Consider small instant loans as a viable option when in need of immediate funds in South Africa.

Small instant loans are quick short-term loans that are typically disbursed within hours of application approval. These loans are usually for small amounts of money and are designed to provide individuals with immediate financial relief.

To qualify for a small instant loan in South Africa, you typically need to be a South African citizen or permanent resident with a valid ID, be over 18 years old, have a steady source of income, and provide proof of address.

Most lenders will require you to provide a copy of your ID, proof of income (such as payslips or bank statements), proof of address, and sometimes additional documentation like proof of employment or contact details for references.

Once your loan application is approved, you can typically expect to receive the funds in your bank account within 24 hours, although some lenders might offer even faster processing times.

Some lenders in South Africa offer small instant loans to individuals with bad credit history, although the interest rates and terms might be less favorable compared to those with good credit scores.

Repayment terms for small instant loans in South Africa vary depending on the lender, but they are typically short-term loans that need to be repaid within a few weeks to a few months.